portland oregon sales tax rate 2020

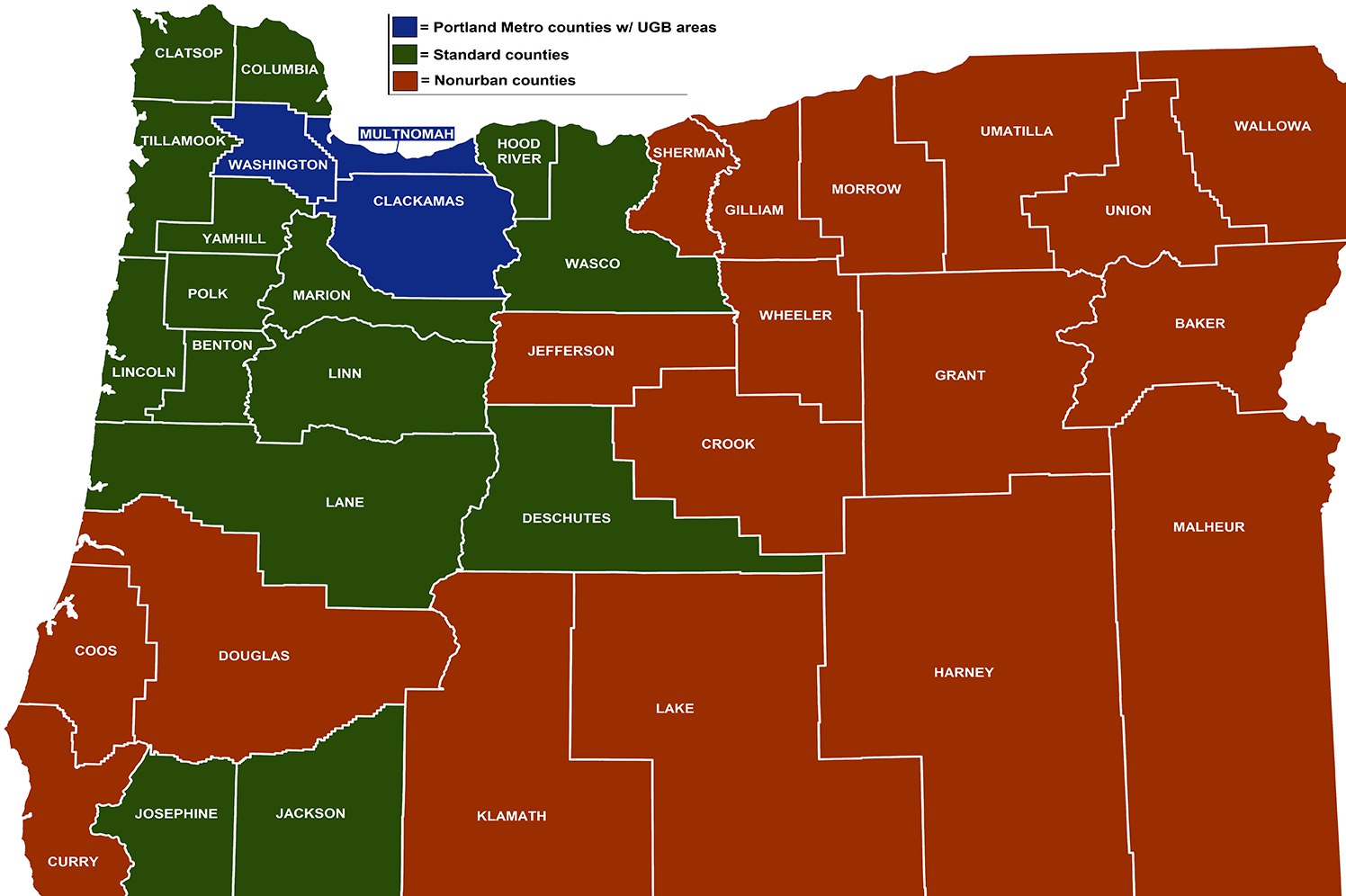

Oregon is one of five states with no statewide sales tax but Oregon law still allows. There are no transfer taxes for Oregon with the sole exception of Washington County.

How Our Us No Sales Tax Feature Helps You Save More Money Buyandship Philippines

This is the total of state county and city sales tax rates.

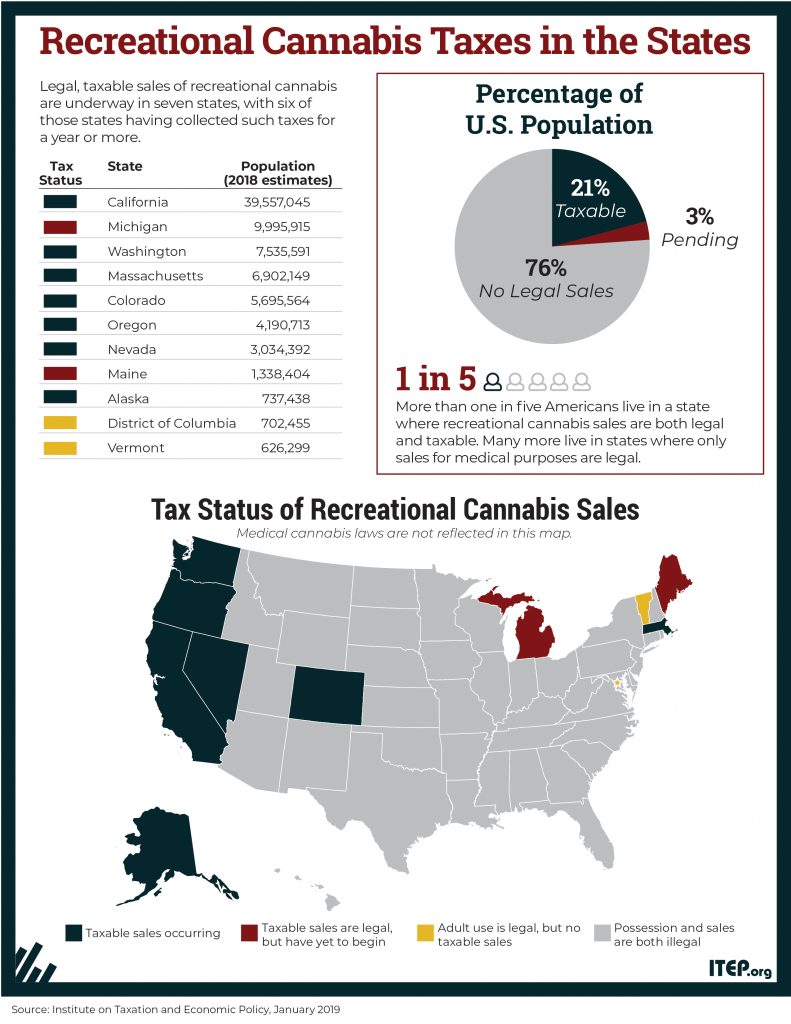

. While many other states allow counties and other localities to collect a local option sales tax Oregon does not. There are a total of 62 local tax jurisdictions across the state collecting an average local tax of NA. The vehicle privilege tax is a tax for the privilege of selling vehicles in Oregon.

Current Tax Rate Filing Due Dates. Oregon is one of 5 states that does not impose any sales tax on purchases made in. Oregon fuel tax rates are as follows.

This rate is made up of a 65 state sales tax and a 10 local sales tax. Aviation Gasoline 011 per gallon. The New Oregon and Portland Taxes on Gross Receipts Oregon Sales Taxes.

In Oregon wine vendors are. The minimum combined 2022 sales tax rate for Portland Oregon is. The state sales tax rate in Oregon is 0000.

Use Fuel 038 per gallon. 2020 rates included for use while preparing your income tax deduction. In 2019 and 2020.

Updated July 28th 2022. The state sales tax rate in Oregon is 0000. 97201 97202 97203 97204 97205 97206 97207 97208 97209 97210 97211 97212 97213 97214 97215.

The current total local sales tax rate in Portland OR is 0000. 24 new employer rate Special payroll tax offset. Sales Tax Breakdown Portland Details.

Use fuel includes premium diesel. For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is imposed on businesses that have at least 500000 in Portland gross income and 1 billion in total. The portland oregon sales tax rate of na applies to the following 43 zip codes.

Portlands local sales tax jurisdictions are made up. Oregons vehicle taxes. What is the sales tax rate in Portland Oregon.

Two Oregon vehicle taxes began January 1 2018. The property tax system is one of the most important sources of revenue for more than 1200 local taxing districts in Oregon. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0.

Property taxes rely on county assessment and taxation offices. The vehicle use tax. There are no local taxes beyond the state rate.

The December 2020 total local sales tax rate was also 0000. Oregon cities andor municipalities dont have a city sales tax. Click here for a larger sales tax map or here for a sales tax table.

The New Oregon and Portland Taxes on Gross Receipts 60 for MBA members 95 non-members. The rate was reduced to 145 in 1993 when the City and. The Oregon sales tax rate is currently.

Jet Fuel 003 per gallon. The sales tax in Portland Oregon is currently 75. The Wayfair decision does affect Oregon businesses selling products online to buyers in a state such as South Dakota that requires online retailers to collect sales tax.

Taxable base tax rate. Real estate transactions in that particular area are subject to. Oregon Wine Tax - 067 gallon Oregons general sales tax of NA does not apply to the purchase of wine.

This is the total of state county and city sales tax rates. The Portland Oregon sales tax is NA the same as the Oregon state sales tax. Gasoline 038 per gallon.

State Income Tax Rates And Brackets 2021 Tax Foundation

States With The Highest And Lowest Sales Taxes

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes

Sales Taxes In The United States Wikipedia

2022 Property Tax Rates In Portland Oregon Virtuance

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Portland Property Taxes Going Up In 2022 Real Estate Agent Pdx

Oregon Minimum Wage In 2022 Square

Portland U S Small Business Administration

State Of Oregon Blue Book Government Finance Taxes

In The News Portland Commercial Real Estate Oregon Office Of Economic Analysis

New Portland Tax Further Complicates Tax Landscape

Monday Map State And Local Sales Tax Rates As Of July 1 2012 Tax Foundation

Portland Voters Put A 1 Tax On Large Retailers But Some Consumers Are Paying It Too Oregonlive Com

States With No Sales Tax Kiplinger

Oregon S New 1 4 Billion Tax What Is Your Business S Share Portland Business Journal

Oregon Office Of Economic Analysis Oregon Economic News Analysis And Outlook

Covid 19 Remote Working Oregon Revenue Apportionment And Nexus Issue Mcdonald Jacobs Portland Oregon Accountants Business Consultants