closed end loan trigger terms

90 financing. The correct answer is.

Under 102624 d 1 whenever certain triggering terms appear in credit advertisements the additional credit terms enumerated in 102624 d 2 must also appear.

. For example if a creditor states no annual fee no points or we waive closing. Regulation Z is structured accordingly. If any of the triggering terms listed above are included in an advertisement the.

A trigger term is used when advertising what type of credit plan. 2 The number of payments or period of repayment. Thus for most closed-end mortgages.

Every day except Sundays and Federal holidays. The APR is not a trigger if its a closed-end loan. Ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages.

Change-in-terms and increased penalty rate. Credit such as credit cards or home-equity lines or closed-end credit such as car loans or mortgages. RV loans up to 108 months.

Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage. The triggering terms are. 10 20 or 30 year mortgages.

Subpart A sections 10261 through 10264 of the regulation provides general. Closed-End Credit Advertising Closed-End. There are triggering terms associated with different loan products such as home equity credit lines closed end credit HELOCs and many other loan products.

The amount of the down payment expressed either as a percentage or as a dollar amount. Refer to Section 22624 for closed-end advertising. 36 to 72 month auto loans.

36 to 72 month auto loans. Closed-End Credit Disclosure Forms Review Procedures. 3 The amount of any payment.

There are triggering terms associated with different loan products such as home equity credit lines closed end credit HELOCs and many other loan products. Or Payments as low as. 1 The amount or percentage of any downpayment.

Unfortunately noif during the loan term a HELOC is converted from open-end credit to closed-end credit that would trigger closed-end credit requirements including the TRID disclosures. Or 4 The amount of any finance charge. If any of the triggering terms listed above are included in an.

Negative as well as affirmative references trigger the requirement for additional information. A triggering term is a word or phrase that legally requires one or more disclosures when used in advertising. However the APR is a triggering term for open-end credit.

Trigger terms when advertising a closed-end loan include. If any of the following terms is set forth in an advertisement the advertisement must include the additional disclosures described in D2. Section 102635 prohibits specific acts and practices in connection with closed-end higher-priced mortgage loans as defined in 102635a.

Only 300 origination fee. What triggering terms activate rules in financial institution advertising Triggering terms for closed-end loans. Triggering terms are defined by the Truth in Lending Act TILA and.

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written. 25 down. The terms annual percentage rate APR though the full use of the term must be used once and finance charge when disclosed with a corresponding amount or rate.

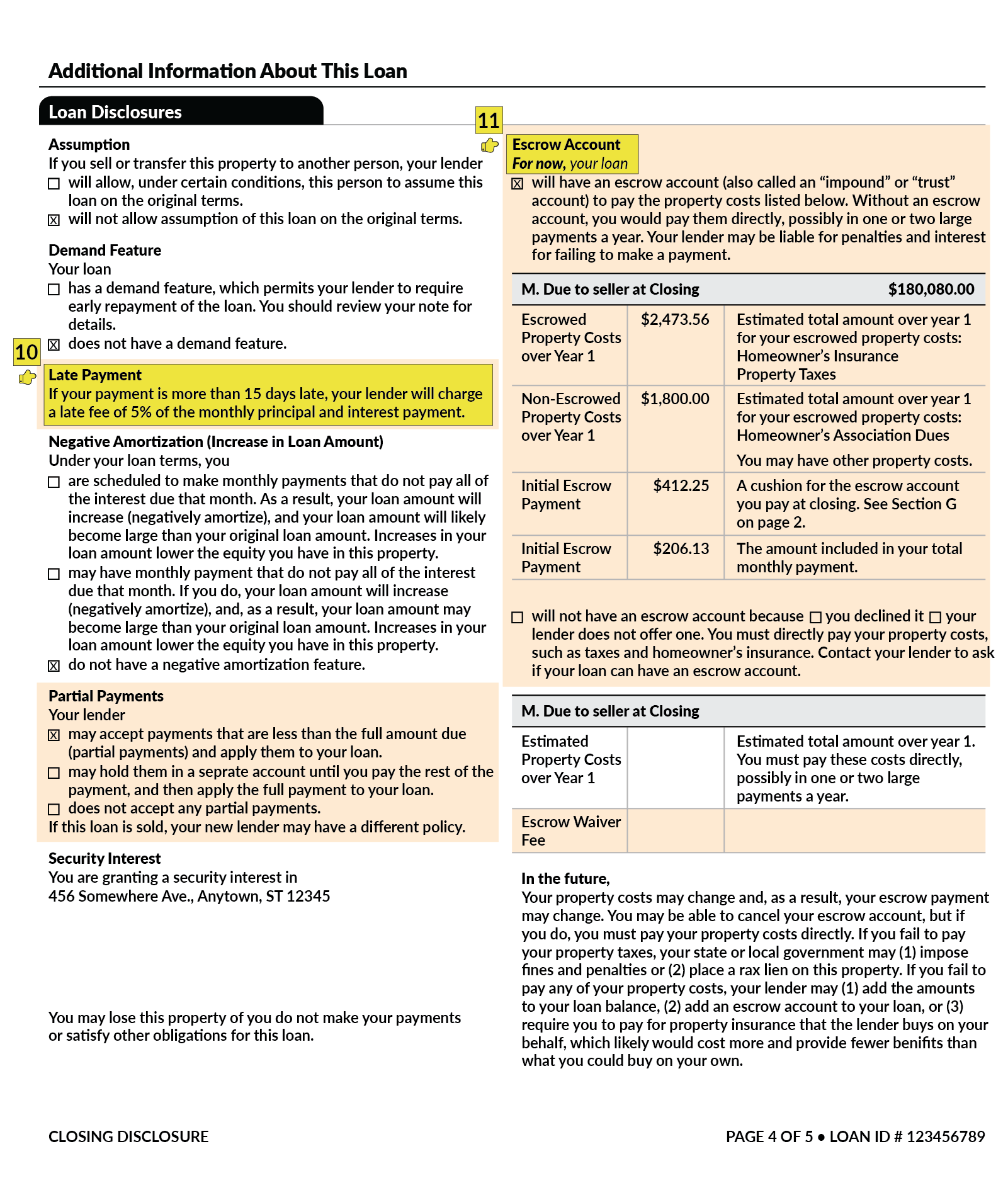

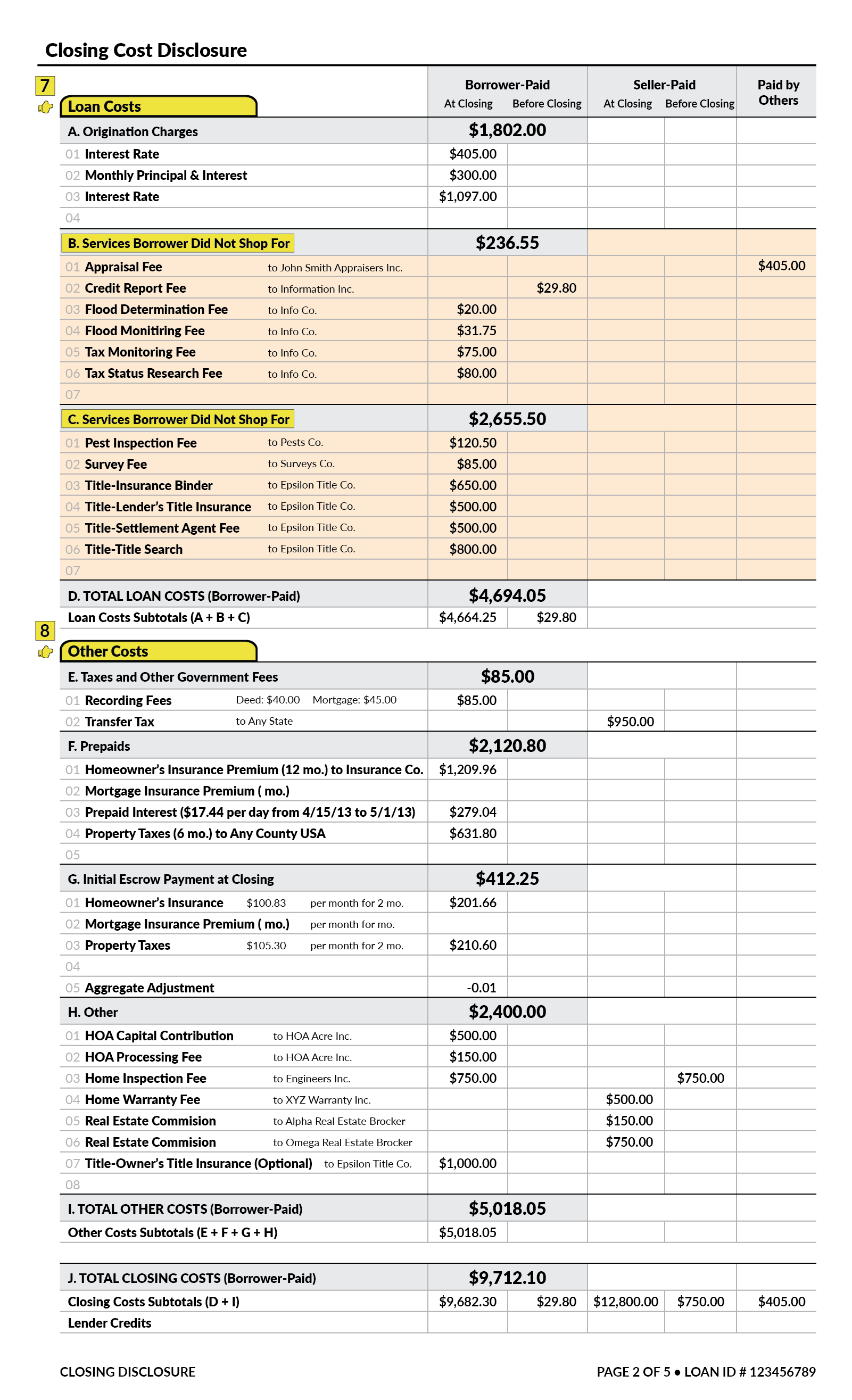

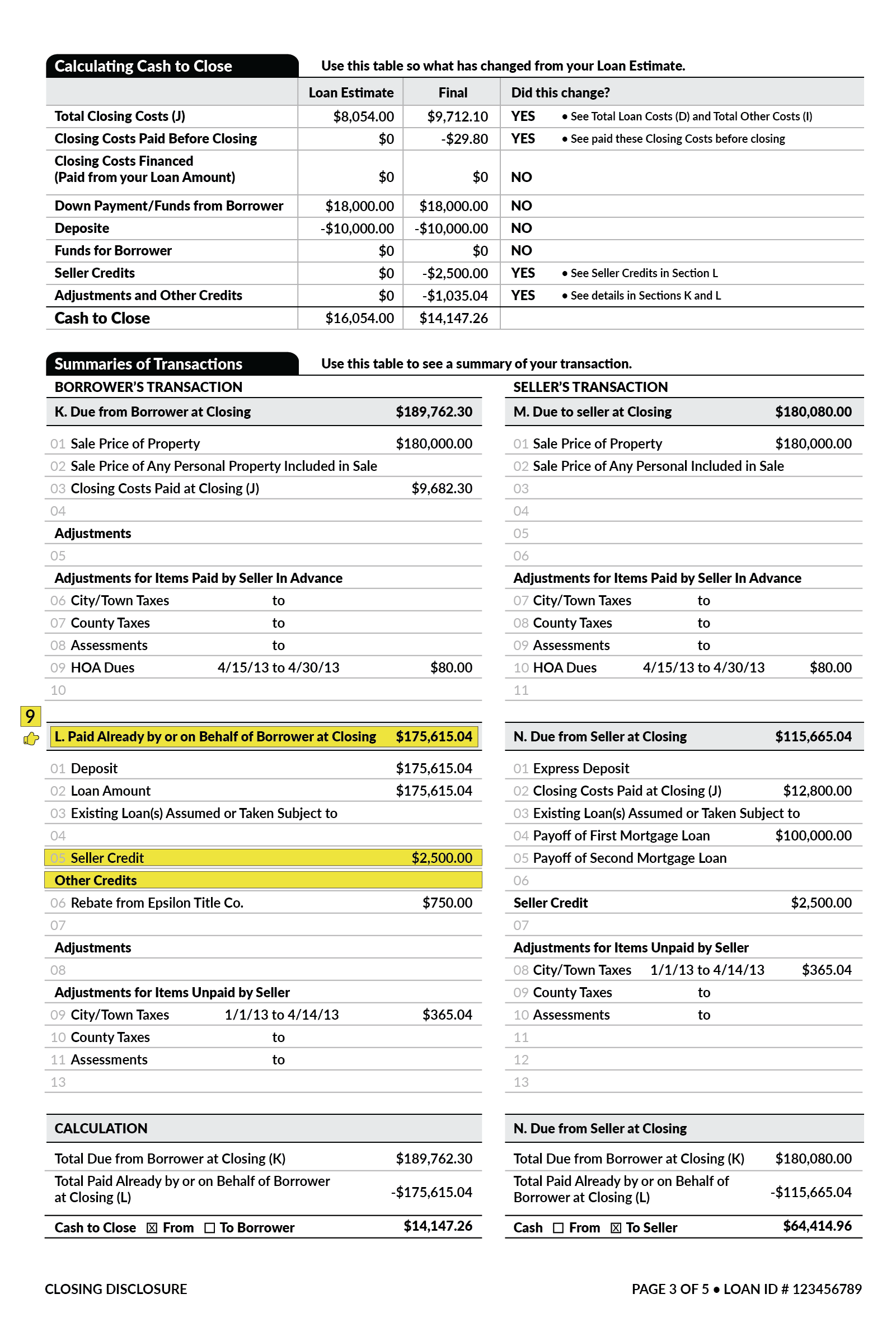

What Is A Closing Disclosure Lendingtree

What Is A Trigger Term In Marketing Rampfesthudson Com

Federal Register Truth In Lending Regulation Z

What Is A Trigger Term In Marketing Rampfesthudson Com

Understanding Commercial Real Estate Loan Covenants During The Pandemic Realogic

/GettyImages-691573721-f38cdb9e10054aa989d411930d774eb9.jpg)

What Is The Truth In Lending Act Tila

What Is A Closing Disclosure Lendingtree

Federal Register Truth In Lending Regulation Z

Federal Register Truth In Lending Regulation Z

What Is A Closing Disclosure Lendingtree

Understanding Finance Charges For Closed End Credit

Federal Register 2012 Truth In Lending Act Regulation Z Mortgage Servicing

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)

:max_bytes(150000):strip_icc()/401_k_istock479882934-5bfc328f46e0fb0051bf266e.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)